| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

This is a good trading opportunity! Keep a close eye on this stock.

Alere (ALR) provides diagnostics and services for cardiology, infectious disease, toxicology, and diabetes in the United States and internationally.

Alere (ALR) provides diagnostics and services for cardiology, infectious disease, toxicology, and diabetes in the United States and internationally.

The company operates in three segments: Professional Diagnostics, Health Information Solutions, and Consumer Diagnostics. The Professional Diagnostics segment provides an array of diagnostic test products and other in vitro diagnostic tests to medical professionals and laboratories for detection of diseases and conditions in the areas of cardiology, infectious diseases, toxicology, diabetes, oncology, and womens health, as well as offers connected device technologies.

The Health Information Solutions segment offers integrated programs and services focused on wellness, disease and condition management, productivity enhancement, and informatics. This segments health management programs comprise disease and case management, womens and childrens health, wellness, and patient self-testing services. The Consumer Diagnostics segment provides products for over-the-counter pregnancy and fertility/ovulation test markets; and over-the-counter drug tests for at-home testing and cholesterol monitoring under the first check brand name, as well as vaginal gel for the treatment of bacterial vaginosis.

Alere Inc. markets its professional diagnostic products to hospitals, reference laboratories, physician offices, and other point-of-care settings through its sales forces and distribution networks; health management programs primarily to commercial and governmental health plans, self-insured employers, government and governmental programs, pharmaceutical companies, and physicians through sales force and channel partners; and consumer drug testing products through retail drug stores, drug wholesalers, groceries, and mass merchandisers.

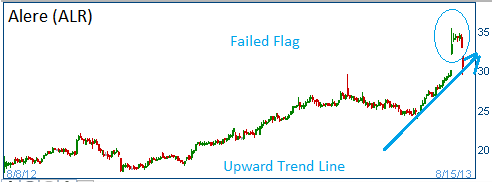

The company reported earnings that beat the estimates. Shares had popped into a bullish "flag" prior to the earnings report. This morning, Craig-Hallum downgraded the stock to sell. Shares are now heading higher on their upward trend line.

Now, this stock should be bought based on our rumors. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares. Today's sell off should create a trading opportunity. Note that Stockwinners principals have taken a position in this stock.

52-Week Trading Range: $17.13 - $35.38

Entry Point: $30.50

Stop Loss: $28.98

Target Price: $33.55

ALR closed at $32.00 after its 30 days was over without reaching our 10%+ target.