| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Federal-Mogul Corporation (FDML) supplies various auto components, accessories, and systems in the United States and internationally.

The company operates in two segments, Powertrain and Vehicle Components Solutions.

The Powertrain segment provides various products, including pistons, piston rings, piston pins, cylinder liners, valve seats and guides, engine bearings, industrial bearings, bushings and washers, ignition products, dynamic seals, bonded piston seals, combustion and exhaust gaskets, static gaskets and seals, rigid heat shields, element resistant sleeving products, flexible heat shields, sintered engine and transmission components, fuel pumps, power and lighting systems, interior and exterior lighting components, and metallic filters.

The Vehicle Components Solutions segment offers light and commercial vehicle disc pads, railway disc pads, light vehicle drum brake linings, commercial vehicle full length linings, commercial vehicle half blocks, railway brake blocks, combustion and exhaust gaskets, static gaskets and seals, and wipers, as well as chassis parts, such as ball joints, tie rod ends, sway bar links, idler arms, and pitman arms. This segment provides its products under the Abex, Beral, Ferodo, Necto, ThermoQuiet, Wagner, MOOG, National, Fel-Pro, Goetze, National, Payen, AE, Carter, FP Diesel, Glyco, Nural, Sealed Power, ANCO, and Champion brand names.

The company serves original equipment manufacturers and servicers of automotive, light, medium and heavy-duty commercial vehicles, off-road, agricultural, marine, rail, aerospace, power generation, industrial equipment, and transport markets, as well as a range of distributors, retail parts stores, and mass merchants.

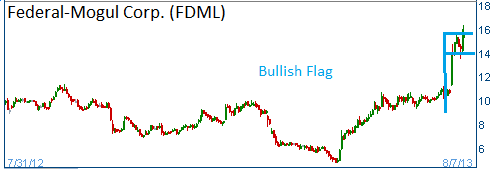

Shares have formed a bullish "flag" and higher share prices are expected for this stock.

We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Trading Range: $4.80 - $16.32

Entry Point: $15.58

Stop Loss: $14.80

Target Price: $17.14

FDML closed at $17.14 after it reached our target. If you elect to stay in the position, please raise yur stop loss to $16.70.