| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Cabela's Incorporated (CAB) operates as a specialty retailer and direct marketer of hunting, fishing, camping, and related outdoor merchandise. The company operates through three segments: Retail, Direct, and Financial Services.

Cabela's Incorporated (CAB) operates as a specialty retailer and direct marketer of hunting, fishing, camping, and related outdoor merchandise. The company operates through three segments: Retail, Direct, and Financial Services.

The Retail segment sells products and services through its retail stores. As of April 25, 2013, it operated 44 stores in the United States and Canada. The Direct segment sells products through its e-commerce Websites, Cabelas.com and Cabelas.ca, as well as direct mail catalogs.

The Financial Services segment issues Cabelas CLUB Visa credit card, a reward based credit card program; certificates of deposits; and underwriting services. Its product portfolio includes merchandise and equipment for hunting, fishing, marine use, and camping, as well as casual and outdoor apparel and footwear, optics, vehicle accessories, and gifts and home furnishings. Cabelas Incorporated offers its Cabelas CLUB Visa credit cards through various channels comprising retail stores, inbound telemarketing, catalogs, and the Internet.

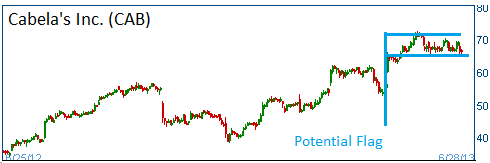

Shares have formed a bullish "flag" and higher share prices are expected for this stock. Note that individual stocks can not escape downward pressure of a market sell off. This stock is no exceptions. Please exercise cautioun.

52-Week Trading Range: $34.24 - $72.54

Entry Point: $65.00

Stop Loss: $61.75

Target Price: $71.50

We are closing CAB position at $66.63 after its 30 days time period expired without reaching our 10% gain.