| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

This is a short pick. That means we expect share prices to move lower. To trade a short pick, you have to have a margin account with your stock broker.

Goldcorp (GG) engages in the acquisition, development, exploration, and operation of precious metal properties in Canada, the United States, Mexico, and Central and South America.

Goldcorp (GG) engages in the acquisition, development, exploration, and operation of precious metal properties in Canada, the United States, Mexico, and Central and South America.

It primarily explores for gold ores, as well as for silver, copper, lead, and zinc ores. The companys principal mining properties include the Red Lake, Porcupine, and Musselwhite gold mines in Canada; the Peñasquito gold/silver/lead/zinc mine, and the Los Filos and El Sauzal gold mines in Mexico; the Marlin gold/silver mine in Guatemala; the Alumbrera gold/copper mine in Argentina; and the Marigold and Wharf gold mines in the United States.

Now that the FOMC has announced that it plans to trim its bond buying program, the dollar will become stronger. A stronger dollar means, lower commodity prices as they are denominated in the dollar. Gold is no exception!

To protect ourselves in case the trade moves against us, we will purchase a Call option to protect the position. One call option represents one hundred shares. So, if you short 100 shares, you need to buy one call option contract for protection.

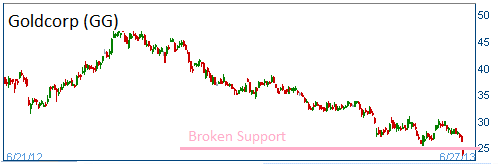

52-Week Trading Range: $23.57 - $47.44

Last Trade: $24.15

Stop Loss: $25.10

Target Price: $20.90 (this includes the $0.90 paid for the protection)

Buy one July $25 Call option for less than $0.90

We are closing the GG position. We are keeping the postion at $25.62. We are also selling our July $25 Call option that we had purchased at $0.90 for $1.45. The exit price is lowered by $0.55.

We are closing the GG position. We are keeping the postion at $25.62. We are also selling our July $25 Call option that we had purchased at $0.90 for $1.45. The exit price is lowered by $0.55.