| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

We have featured this stock several times before with great success. Here we go again! SodaStream International Ltd. (SODA) engages in the development, manufacture, and sale of home beverage carbonation systems that enable consumers to transform ordinary tap water instantly into carbonated soft drinks and sparkling water.

The company operates through four segments: the Americas; Western Europe; the Asia-Pacific; and Central and Eastern Europe, the Middle East, and Africa. It offers a range of soda makers; exchangeable food-grade carbon-dioxide (CO2) cylinders and refills; reusable carbonation bottles; and various flavors to add to the carbonated water, as well as sells additional accessories, such as bottle cleaning materials and ice cube trays.

The company sells its products through approximately 60,000 retail stores in 45 countries. In addition, it distributes Brita water filtration systems in Israel. The company sells its products under the SodaStream and Soda-Club brands directly and through local distributors, as well as over the Internet.

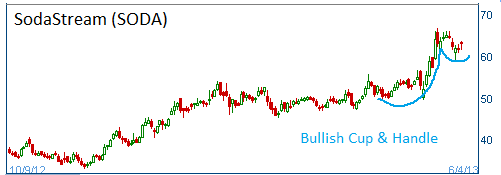

Shares have formed a bullish "cup & handle" and higher prices are expected for this stock.

52-Week Trading Range: $29.44 - $66.69

Entry Point: $62.30

Stop Loss: $59.15

Target Price: $68.53

SODA exceeded our target price. The Position was closed at $69.00. We still believe in the stock. If you keep the position, please adjust your stop loss upward.

SodaStream options active, shares at record high on renewed takeover chatter - SodaStream June 70 and 72 calls are active on total call volume of 1,800 contracts (750 puts). June call option implied volatility is a 49, July is at 44, October is at 41; compared to its 26-week average of 44 according to Track Data. Active call volume suggests traders taking positions on renewed takeover chatter. SODA +$1.55 to $70.61.

SodaStream (SODA), up 5.4% to $73.35 after Israeli newspaper Calcalist reported PepsiCo was in talks to buy the home beverage carbonation systems maker, though Pepsi's CEO told CNBC that the rumor was "totally and completely untrue." Another Israeli publication, Globes, said SodaStream was also in some type of talks with Coca-Cola (KO)...

JPMorgan believes a SodaStream (SODA) partnership with Pepsi (PEP) or Coca-Cola (KO) is more likely than an outright acquisition because there is not much in the way of combined distribution leverage.

In any event, if you are still in this stock, raise your stop loss to $72.50 to protect your gains.