| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

TriNet Group, Inc. (TNET) provides human resources services to small and medium-sized businesses in the United States and Canada.

TriNet Group, Inc. (TNET) provides human resources services to small and medium-sized businesses in the United States and Canada.

The company offers services, such as payroll processing, human capital consulting, and employment law compliance, as well as employee benefits, including health insurance, retirement plans, and workers compensation insurance.

It serves technology, life sciences, property management, professional services, banking and financial services, retail, manufacturing, and hospitality markets, as well as non-profit entities.

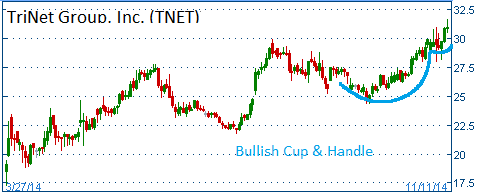

Shares have formed a bullish "cup and handle" and are ready to move higher!

If you decide to open a position, use a Limit Order!

| Company Fundamentals | ||

|---|---|---|

| EPS % Chg (Last Qtr) | 115% | |

| 3 Year EPS Growth Rate | 71% | |

| EPS Est % Chg (Current Yr) | 77% | |

| Sales % Chg (Last Qtr) | 24% | |

| 3-Year Sales Growth Rate | 41% | |

| Debt % | N/A | |

| Market Cap | $2.14 Bil | |

| Profit Margin | 4.5% | |

52- Week Trading Range: $17.28 - $31.66

Entry Point: $31.10

Stop Loss: $29.55

Target Price: $34.21

TNET fell below our stop loss. Closed at $29.50.