| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Vipshop Holdings Limited (VIPS) operates as an online discount retailer for various brands in the People's Republic of China.

Vipshop Holdings Limited (VIPS) operates as an online discount retailer for various brands in the People's Republic of China.

It offers a range of branded discount products, including apparel for women, men, and children; fashion goods; cosmetics; home goods and other lifestyle products; footwear; sportswear and sporting goods; luxury goods; and gifts and miscellaneous products.

The company provides its branded products through its Website vipshop.com, as well as its cellular phone application.

Vipshop in early 2014, spent nearly $200 million on two acquisitions. On February 14, Vipshop acquired 75% equity interest in Lefeng.com from Ovation Entertainment for $132.5 million. Lefeng owns and operates an online retail website specialized in selling cosmetics and fashion products in China.

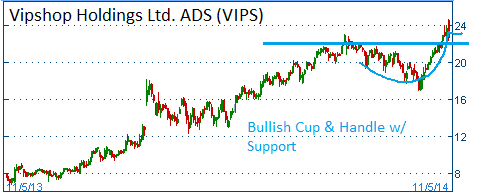

This strategic investment provides Vipshop access to a consistent supply of Ovation branded cosmetic products, which are in high demand among Vipshop's growing user base. Vipshop's CEO said in the statement that about 75% of the company's customers are female. Shares have formed a bullish "cup & handle" and higher share prices are expected for this stock. The firm reports its quarterly results on November 19th. We expect a strong report from the company.

52-Week Trading Range: $7.00 - 24.62

Entry Point: $23.85

Stop Loss: $22.65

Target Price: $26.24

VIPS is down following its strong earnigs report. It should see a recovery today. If you still holding on to the shares, wait and we should see higher prices for the stock.

We are closing the VIPS position at $22.00.