| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

A. Schulman, Inc. (SHLM) supplies plastic compounds and resins for use in packaging, mobility, building and construction, electronics and electrical, agriculture, personal care and hygiene, custom services, sports, home, and leisure markets.

A. Schulman, Inc. (SHLM) supplies plastic compounds and resins for use in packaging, mobility, building and construction, electronics and electrical, agriculture, personal care and hygiene, custom services, sports, home, and leisure markets.

The company provides custom performance colors, including standard and customized colors, organic and inorganic pigments, high chroma colors in translucent or opaque formats, and special effects.

It also offers white color, absorptive, anti-fog, anti-static, carbon black, and other concentrates to improve the performance, appearance, and processing of plastics for intended applications; additive solutions, such as antibacterial, flame retardant, ultra-violet (UV), anti-static, barrier, antioxidant products to enhance performance and processing properties; and application solutions, including solutions that minimize the use of plastics or incorporate the use of either recycled plastics or renewable-based polymers.

In addition, the company develops engineered plastics, which provide structural integrity; multi-component blends that include polyolefins, nylons, polyesters, elastomers, and others; and formulating know-how with fiber reinforcements, such as glass and carbon, nano-reinforcements, flame retardants, impact modifiers, and UV stabilization.

Further, it offers size reduction services; resins for the injection, blow molding, and rotational molding markets; jet milling services used for products requiring fine particle size, including additives for printing inks, adhesives, waxes, and cosmetics; cryogenic milling services for heat sensitive materials; and tolling services. Additionally, the company buys, repackages, and re-sells polymers for various processing types comprising injection molding, blow molding, thermoforming, and film and sheet extruding. It has operations in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

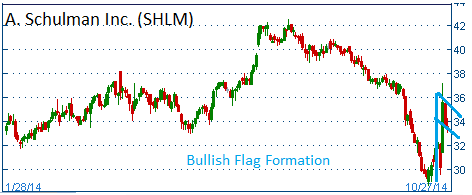

Shares have formed a bullish "flag" after the firm reported strong quarterly results. The company said it had profit of 51 cents per share. Earnings, adjusted for one-time gains and costs, were 66 cents per share. The company also declared a regular quarterly cash dividend of $0.205 per common share. This represents a 2.5% increase over the prior quarter's dividend payout. Higher share prices are expected for this stock.

52-Week Trading Range: $28.67 - $42.51

Entry Point: $33.65

Stop Loss: $31.96

Target Price: $37.02

SHLM reached our target. Closed at $37.20.