| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Palo Alto Networks, Inc. (PANW) provides enterprise security platform to enterprises, service providers, and government entities worldwide.

Palo Alto Networks, Inc. (PANW) provides enterprise security platform to enterprises, service providers, and government entities worldwide.

Its platform includes Next-Generation Firewall that delivers application, user, and content visibility and control, as well as protection against network-based cyber threats; and Threat Intelligence Cloud that offers central intelligence capabilities, as well as automated delivery of preventative measures against cyber attacks.

The company provides firewall appliances; Panorama, a centralized security management solution for the control of appliances deployed on an end-customers network as a virtual or a physical appliance; and Virtual System Upgrades, which are available as extensions to the virtual system capacity that ships with the appliance. It also offers subscription services, such as threat detection and prevention, URL filtering, laptop and mobile devices protection, malware and threats protection, and windows-based fixed and virtual endpoints protection services; support and maintenance services; and professional services, including application traffic management, solution design and planning, configuration, and firewall migration services, as well as provides education services.

The company serves the enterprise network security and endpoint security markets that consist of firewall, unified threat management, Web gateway, intrusion detection and prevention, specialized threat analysis and protection, virtual private network, and enterprise endpoint security technologies.

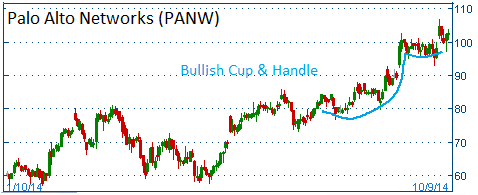

Shares have formed a bullish "cup & handle" following the company's better than expected quarterly results. Higher share prices are expected for this stock.

52-Week Trading Range: $40.36 - $106.79

Entry Point: $102.00

Stop Loss: $96.90

Target Price: $112.20

PANW fell below our sto loss.