| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Skyworks Solutions (SWKS) provides analog semiconductors worldwide.

Skyworks Solutions (SWKS) provides analog semiconductors worldwide.

Its product portfolio includes amplifiers, attenuators, battery chargers, circulators, DC/DC converters, demodulators, detectors, diodes, directional couplers, front-end modules, hybrids, infrastructure radio frequency subsystems, isolators, LED drivers, mixers, modulators, optocouplers, optoisolators, phase shifters, phase locked loops/synthesizers/VCOs, power dividers/combiners, power management devices, receivers, switches, voltage regulators, and technical ceramics.

The company also offers MIS silicon chip capacitors and transceivers.

It provides products for supporting automotive, broadband, cellular infrastructure, energy management, GPS, industrial, medical, military, wireless networking, smartphone, and tablet applications.

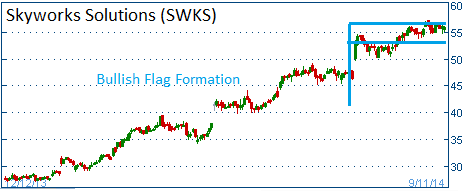

The company sells its products directly, as well as through independent manufacturers representatives and distribution partners. Shares have formed a bullish "flag" and higher share prices are expected for this stock.

52-Week Trading Range: $23.27 - $57.18

Entry Point: $55.84

Stop Loss: $53.05

Target Price: $61.42

SWKS fell below our stop loss. Closed at $53.00