| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

TriQuint Semiconductor (TQNT) provides a portfolio of radio frequency (RF) solutions for mobile device, networks infrastructure, and defense and aerospace markets worldwide.

TriQuint Semiconductor (TQNT) provides a portfolio of radio frequency (RF) solutions for mobile device, networks infrastructure, and defense and aerospace markets worldwide.

It designs, develops, and manufactures high-performance power amplifiers, switches, and filter modules, as well as offers a range of filtering, switching, and amplification products for RF, microwave, and millimeter-wave applications.

The company sells electronic components for mobile phones, including RF filters, duplexers, power amplifier modules, transmit modules, power amplifier + duplexer modules, multi-mode, multi-band power amplifiers, single and dual band wireless local area networks modules, and other advanced products.

It also sells products that support the transfer of voice, video, and data across wireless and wired infrastructure; and provides various products for applications, such as low-noise, variable-gain, driver and power amplifiers, digital and analog attenuators, frequency converters, voltage-controlled oscillators, switches, surface acoustic wave filters, bulk acoustic wave filters, and multi-chip modules. In addition, the company provides die-level ICs, monolithic integrated circuits, and multi-chip modules for radar electronic warfare and communications systems used by military contractors serving the United States government.

Further, it offers foundry services. The company sells its products through independent manufacturers representatives, independent distributors, and direct sales staff.

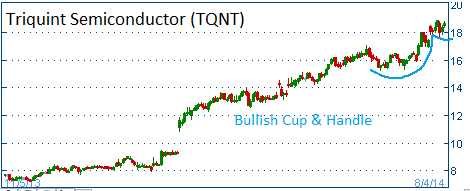

Shares have formed a bullish "cup & handle" following the company's strong quarterly results. Higher share prices are expected for this stock.

52-Week Trading Range: $6.80 - $18.86

Entry Point: $18.60

Stop Loss: $17.65

Target Price: $20.50

TQNT reached our target price. Closed at $20.66. If you elect to stay in the position, raise your stop loss to $20.00 to protect your gains.