| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Skyworks Solutions (SWKS) provides analog semiconductors worldwide.

Skyworks Solutions (SWKS) provides analog semiconductors worldwide.

Its product portfolio includes amplifiers, attenuators, battery chargers, circulators, DC/DC converters, demodulators, detectors, diodes, directional couplers, front-end modules, hybrids, infrastructure radio frequency subsystems, isolators, LED drivers, mixers, modulators, optocouplers, optoisolators, phase shifters, phase locked loops/synthesizers/VCOs, power dividers/combiners, power management devices, receivers, switches, voltage regulators, and technical ceramics.

The company also offers MIS silicon chip capacitors and transceivers. It provides products for supporting automotive, broadband, cellular infrastructure, energy management, GPS, industrial, medical, military, wireless networking, smartphone, and tablet applications. The company sells its products directly, as well as through independent manufacturers representatives and distribution partners.

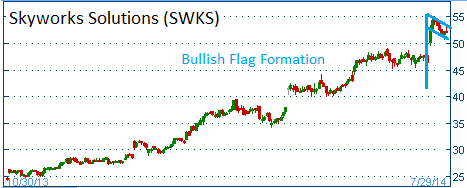

Shares have formed a bullish "flag" following the company's latest quarterly report. The company's products are used in Apple's iPhone and iPad products. In addition, Skyworks also has key clients such as Nest, the maker of smart home products that was acquired by Google earlier this year. According to management, the company has an "extremely strong relationship and high content" at Nest. With Google's backing, Nest might ramp up production going forward and also churn out more innovative products.

Higher share prices are expected for this stock. Note that this stock was last featured in May with success!

52-Week Trading Range: $23.27 - $54.50

Entry Point: $52.50

Stop Loss: $49.87

Target Price: $57.75

We are taking profits on SWKS after its 30-days expired. Closed at $56.67. We do still believe that this stock is heading higher.