| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Trinity Industries, Inc. (TRN) provides various products and services for the energy, transportation, chemical, and construction sectors in the United States, Canada, Mexico, the United Kingdom, Singapore, and Sweden.

Trinity Industries, Inc. (TRN) provides various products and services for the energy, transportation, chemical, and construction sectors in the United States, Canada, Mexico, the United Kingdom, Singapore, and Sweden.

The companys Rail group offers railcars, including auto carrier, box, gondola, hopper, intermodal, specialty, and tank cars; and railcar parts and components comprising couplers, axles, and other equipment. This group serves railroads, leasing companies, and industrial shippers of various products.

The companys Railcar Leasing and Management Services group leases tank and freight railcars to industrial shippers and railroads in chemical, agricultural, energy, and other industries; provides management, maintenance, and administrative services; and manages railcar fleets on behalf of third parties. As of December 31, 2013, this group had a fleet of 75,685 owned or leased railcars.

Its Construction Products group manufactures highway products, such as guardrail, crash cushions, and other protective barriers; provides hot-dip galvanizing services to fabricated steel materials manufacturers; and manufactures construction equipment for the mining industry, as well as trench shields and shoring products for the construction industry. This group also provides aggregates, such as expanded shale and clay, crushed stone, sand and gravel, asphalt rock, and other products, as well as other steel products for infrastructure-related projects.

The companys Energy Equipment group offers structural wind towers; utility, traffic, and lighting structures; storage containers; and tank heads for pressure and non-pressure vessels. Its Inland Barge group provides deck barges, and open or covered hopper barges to transport grain, coal, and aggregates; and tank barges to transport crude oil, chemicals, and petroleum products, as well as fiberglass reinforced lift covers for grain barges.

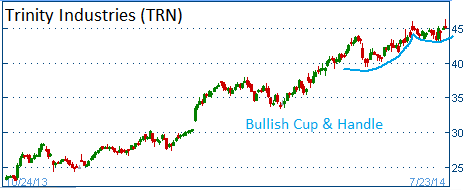

Shares have formed a bullish "cup and handle" and higher share prices are expected for this company. The firm reports its quarterly results on July 29th.

52-Week Trading Range: $18.27 - $46.29

Entry Point: $44.70

Stop Loss: $42.46

Target Price: $49.17

TRN fell below our stop loss. Closed at $42.00