| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Baidu, Inc. (BIDU) provides Internet search services.

Baidu, Inc. (BIDU) provides Internet search services.

The company offers a Chinese language search platform on its Baidu.com Website that enables users to find relevant information online, including Web pages, news, images, documents, and multimedia files, through links provided on its Website; and various international products and services in local languages to users in other countries.

It also provides search products and Web Directory; music products; social-networking products; UGC-based knowledge products; location-based products and services; entertainment products; security products; mobile related products and services; products and services for developers and Webmasters; Web, image, and video search services; other products and services provided by its associated or cooperative websites; and other products and services. In addition, the company offers online marketing services based on search queries, contextuals, audience attributes, display placements, and other forms; and branding display marketing services, and auction-based P4P services.

The company serves online marketing customers consisting of SMEs, large domestic companies, and Chinese divisions or subsidiaries of multinational corporations primarily operating in the medical and healthcare, education, software and online games, tourism and ticketing, machinery, construction and decoration, franchising, electronic commerce, electronic products, business services, transportation, financial services, information technology services, electronic components, and household appliances. It sells its online marketing services directly, as well as through its distribution network.

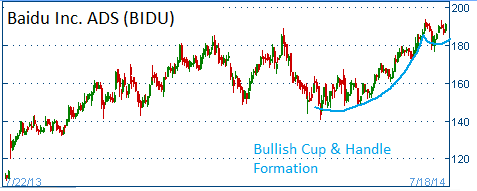

Shares have formed a bullish "cup and handle" and higher share prices are expected for this stock.

52-Week Trading Range: $108.47 - $193.89

Entry Point: $193.00

Stop Loss: $183.35

Target Pirce: $212.30

BIDU reached our target price. Closed at $219.55. Note that we still think there is more upside to this stock.