| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

The Greenbrier Companies, Inc. (GBX) designs, manufactures, and markets railroad freight car equipment in North America and Europe.

The Greenbrier Companies, Inc. (GBX) designs, manufactures, and markets railroad freight car equipment in North America and Europe.

Its Manufacturing Segment offers double-stack intermodal railcars; tanks cars; auto-max railcar, multi-max auto rack, and flat cars for automotive transportation; conventional railcars, such as boxcars, covered hopper cars, flats cars, center partition cars, bulkhead flat cars, and solid waste service flat cars; and pressurized tank cars, non-pressurized tank cars, gondolas and coil cars, coal cars, sliding wall cars, and automobile transporter cars; and marine vessels, including conventional deck barges, double-hull tank barges, railcar/deck barges, barges for aggregates, and other heavy industrial products and dump barges.

The companys Wheels, Repair & Parts segment provides wheel services, including reconditioning of wheels and axles, new axle machining and finishing, and axle downsizing; heavy railcar repair and refurbishment, as well as routine railcar maintenance; and repair and refurbishment of railcars for third parties. This segment also reconditions railcar cushioning units, couplers, yokes, side frames, bolsters, and various other parts, as well as produces roofs, doors, and associated parts for boxcars.

Its Leasing & Services segment offers operating leases and by the mile leases for a fleet of approximately 8,600 railcars; and management services, including railcar maintenance management, railcar accounting services, fleet management, administration, and railcar remarketing. This segment owns or provides management services to a fleet of approximately 232,000 railcars. The companys customers include railroads, leasing companies, financial institutions, shippers, carriers, and transportation companies.

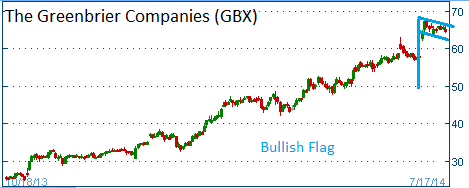

Shares have formed a bullish "flag" following the company's strong results. The firm also guided higher going forward. The company r recorded net profit of $33.59 million, or $1.03 per share (74 cents expected), in the third quarter ended May 31. Revenue increased 36.8 percent to $593.3 million ($571.1 million expected). The company said it now expects adjusted full-year profit of $2.98-$3.08 per share, up from $2.45-$2.70 forecast earlier.

Higher share prices are expected for this stock.

52-Week Trading Range: $22.16 - $67.84

Entry Point: $64.61

Stop Loss: $61.38

Target Price: $71.07

GBX fell below our stop loss. Closed at $61.20.