| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Qihoo 360 Technology Co. Ltd. (QIHU) provides Internet and mobile security products and services in the People's Republic of China.

Qihoo 360 Technology Co. Ltd. (QIHU) provides Internet and mobile security products and services in the People's Republic of China.

Its core Internet security products include 360 Safe Guard, a solution for Internet security and system optimization; 360 Anti-Virus, an anti-virus application that uses multiple scan engines to protect users computers against various kinds of malware, as well as 360 Mobile Safe, a security program for the Google Android, Apple iOS, and Windows smartphone operating systems.

The companys platform products comprise 360 Safe Browser and 360 Speed Browser, which are based on dual-core technologies providing secure browsing and blocking malicious Websites, indentifying them among search results, scanning files downloaded through the browser for security threats, as well as 360 Mobile Browser for the iOS and Android operating systems.

Its 360 browsers also consist of 360 Personal Start-up Page, which serves as users start-up page aggregating preferred Web services and applications; 360 Search, a search engine; and 360 Mobile Assistant, which allows users to browse, search, and obtain various mobile applications for mobile devices.

The company also provides online advertising service; Internet value-added services; and online lottery purchase services, as well as serves as an agent for providing online distribution services and payment collections services.

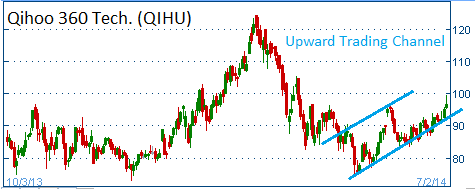

Shares are heading higher in an upward trading channel. We expect higher prices for this stock.

| Trailing P/E (ttm, intraday): | 87.32 |

| Forward P/E (fye Dec 31, 2015): | 24.72 |

| PEG Ratio (5 yr expected): | 0.99 |

| Price/Sales (ttm): | 14.11 |

| Price/Book (mrq): | 14.64 |

52-Week Trading Range: $47.55 - $124.42

Entry Point: $96.75

Stop Loss: $91.90

Target Price: $106.42

QIHU fell below our stop loss. Closed at $87.45