| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Super Micro Computer (SMCI) develops and provides high performance server solutions based on modular and open-standard architecture in the United States and internationally.

Super Micro Computer (SMCI) develops and provides high performance server solutions based on modular and open-standard architecture in the United States and internationally.

It offers a range of server, storage, blade, workstation, and full rack solutions, as well as networking devices and server management software that are used by distributors, original equipment manufacturers (OEMs), and end customers. The company provides various server options with single, dual, and quad central processing unit capability supporting Intel Pentium and Xeon multi-core architectures; and server systems based on AMD dual and quad Opteron.

It also offers server subsystems and accessories, including server boards, and chassis and power supplies; and other system accessories, such as microprocessors, memory, and disc drives.

The company offers its products to data center, cloud computing, enterprise, hadoop/big data, high performance computing, and embedded markets. Super Micro Computer, Inc. sells its server systems, and server subsystems and accessories primarily through distributors, which include value added resellers and system integrators; OEMs; and direct sales force.

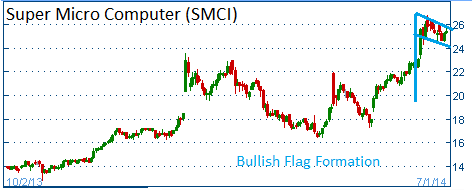

Shares have formed a bullish "flag" after the company introduced a series of new products. Higher share prices are expected for this stock.

Here are some ket statistics for this company.

| Trailing P/E (ttm, intraday): | 25.11 |

| Forward P/E (fye Jun 30, 2015)1: | 15.61 |

| PEG Ratio (5 yr expected)1: | 1.61 |

| Price/Sales (ttm): | 0.83 |

| Price/Book (mrq): | 2.54 |

| Enterprise Value/Revenue (ttm)3: | 0.77 |

52-Week Trading Range: $10.89 - $26.80

Entry Point: $25.44

Stop Loss: $24.16

Target Price: $27.99

We are closing SMCI at $26.50 after it failed to reach our target price in less than 30 days.