| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Rexnord Corporation (RXN) designs, manufactures, markets, and services process and motion control, and water management products worldwide.

Rexnord Corporation (RXN) designs, manufactures, markets, and services process and motion control, and water management products worldwide.

The company operates through two segments, Process & Motion Control Platform and Water Management Platform.

The Process & Motion Control Platform segment designs, manufactures, markets, and services mechanical components used in complex systems. It offers gears, couplings, industrial bearings, aerospace bearings and seals, chains, engineered chains, and conveying equipment under the brand names of Steelflex, Thomas, Omega, Rex, Viva, Wrapflex, Lifelign, True Torque, Addax, Autogard, FlatTop, PSI, Cartriseal, Precision Gear, Micro Precision, Rexnord, Falk, and Link-Belt. This segment offers its products through distributors to mining, general industrial, cement and aggregates, agriculture, forest and wood products, petrochemical, energy, food and beverage, aerospace, and wind energy markets.

The Water Management Platform segment designs, procures, manufactures, and markets products that provide and enhance water quality, safety, flow control, and conservation. It offers specification drainage products, flush valves and faucet products, backflow prevention pressure release valves, PEX piping used in nonresidential construction end-markets, and engineered valves and gates for the water and wastewater treatment market under the brand names of Zurn, Wilkins, VAG, GA, Rodney Hunt, and Fontaine. This segment sells its products through independent sales representatives, sales agencies, and direct sales and marketing associates in 49 countries.

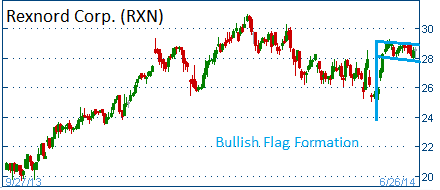

Shares have formed a bullish "flag" after the company sold 15 million shares which was over subscribed to. The shares were purchased by Apollo Global Management. Higher share prices are expected for this stock.

52-Week Trading Range: $16.83 - $30.94

Entry Point: $28.65

Stop Loss: $27.22

Target Price: $31.55

RXN closed at $27.50 after it failed to reach our target price in less than 30 days!