| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

ARRIS Group, Inc. (ARRS) provides media entertainment and data communications solutions in the United States and internationally.

ARRIS Group, Inc. (ARRS) provides media entertainment and data communications solutions in the United States and internationally.

The company operates in two segments, Customer Premises Equipment and Network & Cloud.

The Customer Premises Equipment segment offers various product solutions, including set-top boxes, gateways, digital subscriber lines and cable modems, and embedded multimedia terminal adapters and voice/data modems that enable service providers to offer voice, video, and high-speed data services to residential and business subscribers.

The Network & Cloud segment provides hybrid fiber coax equipment, edge routers, metro Wi-Fi, video management, storage, and distribution equipment for cable providers; and fiber-based and copper-based broadband transmission equipment for telco providers. This segment also offers video headend management system for legacy moving picture experts group/digital video broadcasting systems, as well as full Internet protocol video systems; support for multi-screen video management, protection, monetization, and delivery; and various products for performance management, configuration, and surveillance.

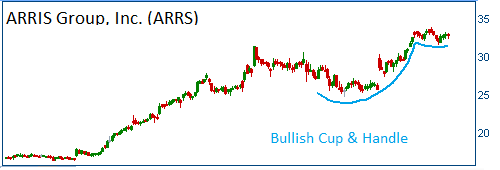

Shares have formed a bullish "Cup and Handle" and higher share prices are expected for this stock. Here are some stats about this company:

| Enterprise Value (Jun 19, 2014): | 5.92B |

| Forward P/E (fye Dec 31, 2015): | 11.12 |

| PEG Ratio (5 yr expected): | 0.54 |

| Price/Sales (ttm): | 1.06 |

| Price/Book (mrq): | 3.47 |

52-Week Trading Range: $14.15 - $33.87

Entry Point: $32.85

Stop Loss: $30.90

Target Price: $36.08

ARRS closed at $33.00 after it failed to gain 10% in less than 30 days.