| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

AmTrust Financial Services (AFSI) underwrites and provides property and casualty insurance in the United States and internationally.

The company operates in four segments: Small Commercial Business, Specialty Risk and Extended Warranty, and Specialty Program, and Personal Lines Reinsurance.

The Small Commercial Business segment offers workers compensation, commercial package, and other commercial insurance lines to small businesses, such as restaurants, retail stores, physicians, and other professional offices through wholesale and retail agents, and brokers. The Specialty Risk and Extended Warranty segment provides coverage for consumer and commercial goods; custom designed coverages, such as accidental damage plans and payment protection plans; and coverage for niche property, casualty, and specialty liability risks comprising general liability, employers liability, and professional and medical liability. This segment also serves as a third party administrator to offer claims handling and call center services to the consumer products and automotive industries in the United States and Canada. The Specialty Program segment provides workers compensation; package products; general liability; commercial auto liability; excess and surplus lines programs; and other specialty commercial property and casualty insurance. This segment serves small and middle market companies through general and wholesale agents. The Personal Lines Reinsurance segment, through a quota share reinsurance agreement, reinsures 10% of the net premiums of personal lines business of the National General Holdings Corp.

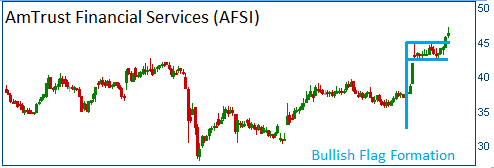

Shares have formed a bullish "flag" after the firm reported a better than expected quarterly report. Higher share prices are expected for this stock.

52-Week Trading Range: $27.90 - $47.10

Entry Point: $46.20

Stop Loss: $43.85

Target Price: $50.82

AFSI fell below our stop loss.