| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

MercadoLibre (MELI) hosts online commerce platforms in Latin America.

MercadoLibre (MELI) hosts online commerce platforms in Latin America.

Its services are designed to provide users with mechanisms for buying, selling, paying, collecting, generating leads, and comparing listings through e-commerce transactions.

The company principally offers MercadoLibre marketplace, an automated online e-commerce service, which permits businesses and individuals to list items and conduct their sales and purchases online in a fixed-price or auction-based format.

Its MercadoLibre marketplace enables registered users to list and purchase motor vehicles, vessels, aircraft, real estate, and other services through online classified listings; and Internet users to browse through various products and services that are listed on its Website and to register with MercadoLibre to list, bid for, and purchase items and services.

The company also provides MercadoPago, an integrated online payments solution to facilitate transactions on and off the MercadoLibre marketplace by providing a mechanism that allows its users to send, receive, and finance payments online.

As of December 31, 2012, the company operated online commerce platforms directed towards Argentina, Brazil, Chile, Colombia, Costa Rica, the Dominican Republic, Ecuador, Mexico, Panama, Peru, Portugal, Uruguay, and Venezuela; online payments solutions directed towards Argentina, Brazil, Chile, Colombia, Mexico, and Venezuela; and a real estate classified platform that covers various areas in Florida.

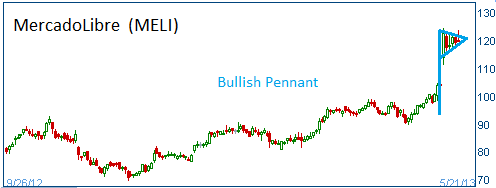

Shares have formed a bullish "pennant" following the release of its quarterly results. Higher share prices are expected for this stock.

52-Week Trading Range: $64.18 - $124.40

Entry Point: $120.00

Stop Loss: $114.00

Target Price: $132.00

MELI fell below our stop loss of $114.00. The position was closed but this stock is heading higher and we believe in the firm.