| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Masco Corporation (MAS) engages in the manufacture, distribution, and installation of home improvement and building products primarily in North America and Europe.

Masco Corporation (MAS) engages in the manufacture, distribution, and installation of home improvement and building products primarily in North America and Europe.

The company operates through five segments: Cabinets and Related Products, Plumbing Products, Installation and Other Services, Decorative Architectural Products, and Other Specialty Products. The Cabinets and Related Products segment manufactures and sells stock and semi-custom assembled, and ready-to-assemble cabinetry for kitchen, bath, storage, home office, and home entertainment applications, as well as kitchen countertops, and integrated bathroom vanity and countertop solutions. The Plumbing Products segment offers single-handle and double-handle faucets, showerheads, handheld showers, valves, and toilets; tub and shower systems, bath and shower enclosure units, shower trays, and laundry tubs, as well as spas; and brass and copper plumbing system components, and other plumbing specialties. The Installation and Other Services segment sells installed building products, such as gutters, after-paint products, fireplaces, and garage doors, as well as insulation and insulation accessories, and roofing and other products. The Decorative Architectural Products segment produces architectural coatings, including paints, primers, specialty paint products, stains, and waterproofing products; and cabinet, door, window, and other hardware products. The Other Specialty Products segment manufactures and sells vinyl, fiberglass, and aluminum windows and patio doors; and manual and electric staple gun tackers, staples, and other fastening tools.

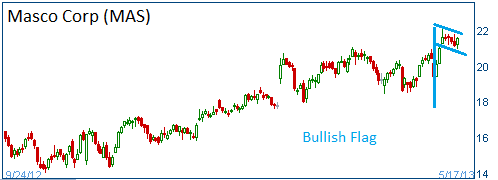

Shares have formed a bullish "flag" following the release of its quarterly results and higher prices are expected for this stock.

We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Trading Range: $11.53 - $22.10

Entry Point: $21.50

Stop Loss: $20.42

Target Price: $23.65

MAS fell below our stop loss. The position was closed at $20.35.