| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

On Assignment (ASGN) is a diversified professional staffing firm, provides short- and long-term placement of contract, contract-to-hire, and direct hire professionals in the United States, Europe, Canada, China, Australia, and New Zealand.

The company operates in five segments: Apex, Oxford, Life Sciences, Healthcare, and Physician.

The Apex segment provides mission-critical information technology (IT) operations professionals for contract, contract-to-hire, and permanent placement positions to Fortune 1000 and mid-market clients. It serves companies from industries, including financial services, business services, consumer and industrials, technology, healthcare, government services, and communications.

The Oxford segment provides high-end contract and direct placement services of IT and engineering professionals in the specialized IT; software and hardware engineering; and mechanical, electrical, validation, and telecommunications engineering fields.

The Life Sciences segment offers contract, contract-to-permanent, and direct placement services of laboratory and scientific professionals to the biotechnology, pharmaceutical, food and beverage, medical device, personal care, chemical, and environmental industries. Its contract staffing specialties include chemists, clinical research associates, clinical lab assistants, engineers, biologists, biochemists, microbiologists, molecular biologists, food scientists, regulatory affairs specialists, lab assistants, and other scientific professionals.

The Healthcare segment provides professionals, such as nurses, specialty nurses, respiratory therapists, surgical technicians, imaging and X-ray technicians, medical technologists, phlebotomists, coders, billers, claims processors, and collections staff. The Physician segment offers contract and direct placement physicians in hospitals; community-based practices; and federal, state, and local facilities.

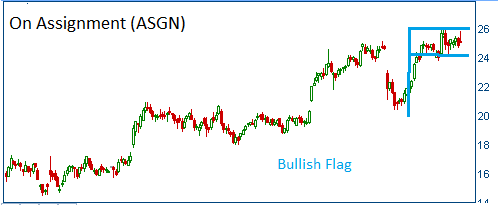

Today's ADP Employment report came in weaker than expected. The news should offer a bettery entry point into this stock. Note that we release our pick in the first 30 minutes of the market open, however we expect the stock to weaken throughout the morning. You maybe able to get in around $24. Wait! Shares have formed a bullish "flag" following the company's earnings report, and are expected to move higher out of this formation.

52-Week Trading Range: $14.48 - 26.09

Entry Point: $24.80

Stop Loss: $23.56

Target Price: $27.28

Stock fell below our stop loss. The issue was closed at $23.50