| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Aspen Technology (AZPN) provides process optimization software solutions to manage and optimize plant and process design, operational performance, and supply chain planning internationally.

Aspen Technology (AZPN) provides process optimization software solutions to manage and optimize plant and process design, operational performance, and supply chain planning internationally.

The company designs and develops a suite of aspenONE software applications for use in the areas of engineering, manufacturing, and supply chain. Its aspenONE engineering software products include Aspen Plus and Aspen HYSYS process modeling software for conceptual design, optimization, and performance monitoring to chemical and energy industries; Aspen Exchanger Design and Rating software used to design, simulate, and optimize the performance of heat exchangers; Aspen Economic Evaluation for estimating costs of conceptual process designs; Aspen Basic Engineering, a workflow tool that allows engineers to build, re-use, and share process models and data; and Sulsim sulfur simulation software.

The companys aspenONE manufacturing software products comprise Aspen InfoPlus.21, a data historian software that collects and stores data for analysis and reporting; and Aspen DMCplus, a multi-variable controller software for processing various constraints. Its aspenONE supply chain software products comprise Aspen Collaborative Demand Manager, Aspen Petroleum Scheduler, Aspen PIMS Platinum, Aspen Plant Scheduler, Aspen supply chain planner, Aspen Inventory Management & Operations Scheduling, Aspen Petroleum Supply Chain Planner, and Aspen Fleet Optimizer, which enable process manufacturers to reduce inventory levels, enhance asset efficiency, and optimize supply chain operations.

The company also offers software maintenance and support, professional, and training services. It serves customers in the process industries, including energy, chemicals, engineering, and construction, as well as consumer packaged goods, power, metals and mining, pulp and paper, pharmaceuticals, and biofuels.

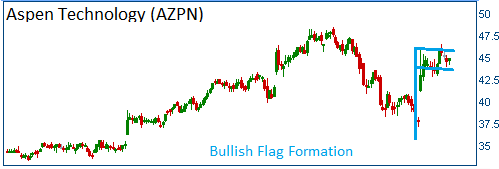

Shares have formed a bullish "flag" after the firm reported strong quarterly results. AZPN reported a more than 30% rise in revenue in its most recent quarter. Adjusted earnings per share doubled, and Aspen Technology had strong success in boosting its sales from subscriptions and software. Higher share prices are expected for thsi stock.

52-Week Trading Range: $28.35 - $48.39

Entry Point: $44.65

Stop Loss: $42.40

Target Price: $49.20

Closing AZPN trade after it failed to gain 10% in 30 days or less. Closed at $45.80.