| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Power Integrations (POWI) designs, develops, manufactures, and markets analog and mixed-signal integrated circuits (ICs), and other electronic components and circuitry used in high-voltage power conversion.

Power Integrations (POWI) designs, develops, manufactures, and markets analog and mixed-signal integrated circuits (ICs), and other electronic components and circuitry used in high-voltage power conversion.

The company offers AC-DC conversion products, including TOPSwitch, TinySwitch, and LinkSwitch that address power supplies ranging from less than 1 watt of output up to approximately 50 watts of output for mobile-device chargers, consumer appliances, utility meters, liquid crystal display monitors, standby power supplies for desktop computers and televisions, and other consumer and industrial applications.

It also provides various products for use in applications up to approximately 500 watts of output, such as Hiper family power-conversion and power-factor-correction products for high-power applications, which include main power supplies for desktop computers, televisions, and game consoles, as well as light emitting diode street lights and other applications; CapZero and SenZero products that reduce standby consumption in high-power applications by eliminating power waste; and high-voltage diodes.

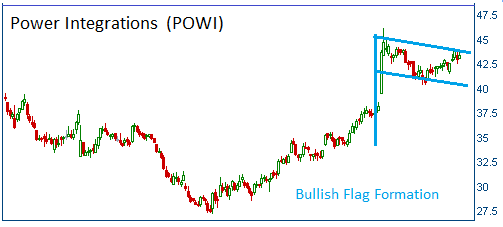

Shares have formed a bullish "flag" and higher prices are expected for this stock.

52-Week Trading Range: $27.20 - $46.12

Entry Point: $42.60

Stop Loss: $40.47

Target Price: $46.86

POWI was closed at $40.40 as it fell below our stop loss.