| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Knight Transportation (KNX) operates as a short to medium-haul truckload carrier of general commodities primarily in the United States.

Knight Transportation (KNX) operates as a short to medium-haul truckload carrier of general commodities primarily in the United States.

The company operates in two segments, Asset-Based and Non-Asset-Based.

The Asset-Based segment provides truckload carrier dry van; temperature-controlled (refrigerated); dedicated truckload; and drayage services between ocean ports, rail ramps, and shipping docks. The Non-Asset-Based segment provides logistics, freight management, freight brokerage, rail intermodal, and other non-trucking services.

As of December 31, 2013, it operated 3,537 company-owned tractors, as well as had 452 tractors under contract that are owned and operated by independent contractors, as well as operated an average of 9,406 trailers.

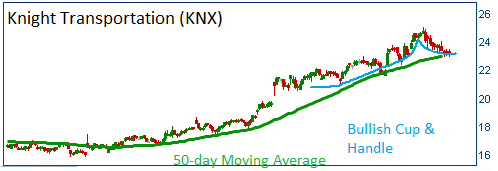

Shares have formed a bullish "cup and handle" after the firm reported solid quarterly results. The formation is supported by the stock's 50-day moving average. Higher share prices are expected for this stock.

52-Week Trading Range: $15.88 - $25.00

Entry Point: $23.26

Stop Loss: $22.08

Target Price: $25.59

KNX closed at $24.40 after it failed to gain 10% in less than 30 days.