| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Fiserv, Inc. (FISV) provides financial services technology worldwide.

Fiserv, Inc. (FISV) provides financial services technology worldwide.

The companys Payments and Industry Products segment offers electronic bill payment and presentment, card-based transaction processing and network services, ACH transaction processing, account-to-account transfer products, and person-to-person payments; Internet and mobile banking systems; and related services, including document and payment card production and distribution, check processing and imaging, source capture systems, and lending and risk management products and services. This segment also provides investment account processing services for separately managed accounts, card and print personalization services, and fraud and risk management products and services.

Its Financial Institution Services segment offers account processing services, item processing and source capture services, loan origination and servicing products, cash management and consulting services, and other products and services that support various types of financial transactions to banks, thrifts, and credit unions.

The company also provides consumer and business payments solutions, such as account-to-account transfer, account opening and funding, data aggregation, small business invoicing and payments, and person-to-person payments services. It serves banks, thrifts, credit unions, investment management firms, leasing and finance companies, retailers, merchants, and government agencies.

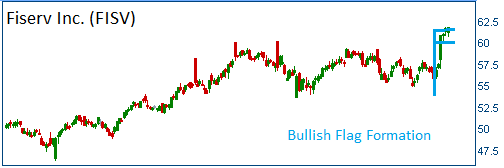

Shares have formed a bullish "flag" after the firm reported its quarterly results. Higher share prices are expected for this stock.

52-Week Trading Range: $42.30 - $61.75

Entry Point: $61.70

Stop Loss: $58.60

Target Price: $67.87

FISV closed at $61.10 after it failed to gain 10% in less than 30 days.