| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Trimble Navigation Limited (TRMB) designs and distributes positioning products and applications enabled by global positioning system (GPS), optical, laser, and wireless communications technology.

Trimble Navigation Limited (TRMB) designs and distributes positioning products and applications enabled by global positioning system (GPS), optical, laser, and wireless communications technology.

The companys Engineering and Construction segment offers software for optimized route selection and design; systems to automatically guide and control construction equipment, such as bulldozers, graders and paving equipment; systems to monitor, track, and manage assets, equipment, and workers; and software to facilitate the sharing and communication of data in real time.

Its Field Solutions segment provides agriculture products consisting of guidance and positioning systems, automated application systems, and information management solutions that enable farmers to enhance crop performance, profitability, and environmental quality. The companys Mobile Solutions segment offers vehicle solutions, such as GPS receivers, business logic, sensor interfaces, and wireless modems; mobile worker solutions to automate service technician work in the field; and scheduling and dispatch solution, an enterprise software program to optimize scheduling and routing of field service technicians.

Its Advanced Devices segment supplies global navigation satellite system modules (GNSS), licensing and complementary technologies, and GNSS-integrated sub-system solutions; GPS receivers and embedded modules for aircraft navigation and timing applications; information for outdoor recreational activities; precision products; and ultra high frequency radio frequency identification (RFID) reader modules, and finished/fixed-position RFID readers and design services.

It serves agriculture, architecture, civil engineering, construction, environmental management, government, natural resources, transportation, and utilities industries through dealers, distributors, and authorized representatives worldwide.

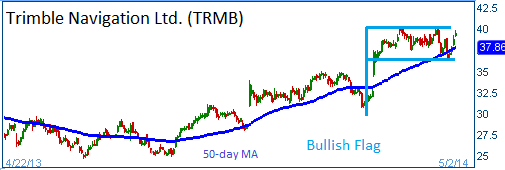

Shares have formed a bullish "flag" and higher share prices are expected for this stock. The formation is supported by the stock's 50-day moving average. The firm reports its quarterly results next week and we expect another strong report from the firm.

52-Week Trading Range: $24.66 - $40.17

Entry Point: $39.50

Stop Loss: $37.50

Target Price: $43.45

TRMB fell below our stop loss after it missed its quarterly results!