| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Evercore Partners (EVR) operates as an independent investment banking advisory firm.

Evercore Partners (EVR) operates as an independent investment banking advisory firm.

The company operates through two segments, Investment Banking and Investment Management.

The Investment Banking segment offers advisory services on mergers, acquisitions, divestitures, and other strategic corporate transactions primarily for multinational corporations and private equity firms; and restructuring advice to companies in financial transition, as well as to creditors, shareholders, and potential acquirers. This segment also provides capital markets advice; underwrites securities offerings; raises funds for financial sponsors; and offers equity research and agency-only equity securities trading for institutional investors. The Investment Management segment manages financial assets for institutional investors; provides independent fiduciary services to corporate employee benefit plans; provides wealth management services for high net-worth individuals; manages private equity funds; and offers specialized investment management and trustee services. The company serves its clients worldwide.

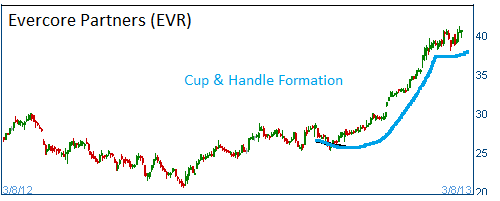

Shares have formed a bullish "Cup & Handle" and higher prices are expected for this stock. Note that a very low interest rate, and high stock prices are a fertile ground for M&A activities that should help EVR, KKR and APO.

52-Week Trading Range: $20.57 - $43.67

Entry Point: $42.50

Stop Loss: $40.35

Target Price: $46.75

EVR fell below our stop loss of $40.35. It was closed at $40.33