| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

This is a short pick. It means, we expect shares to drop in price. Please follow the stop losses carefully as shorting a stock could make your losses unlimited (theoretically that is). You must have a margin account to short. Shorting is not allowed in most retirement accounts.

Riverbed Technology (RVBD) provides solutions to the fundamental problems associated with information technology (IT) performance across wide area networks (WANs). It offers Steelhead products, which enable customers to enhance the performance of applications and access data across WANs.

Riverbed Technology (RVBD) provides solutions to the fundamental problems associated with information technology (IT) performance across wide area networks (WANs). It offers Steelhead products, which enable customers to enhance the performance of applications and access data across WANs.

In addition, the company provides OPNET products that use various technologies to support the analysis of application, network, and server performance under a range of conditions; Stingray product line, which provides virtual application delivery control; and Whitewater, a cloud storage appliance to accelerate, deduplicate, secure, and store backup data sets in the public cloud. It serves customers in manufacturing, finance, technology, government, architecture, engineering and construction, professional services, utilities, healthcare and pharmaceuticals, media, and retail industries.

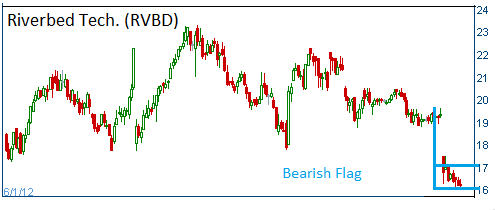

Shares have formed a bearish "flag" following its quarterly results. Lower prices are expected for this stock.

52-week Trading Range: $13.30 - $29.59

Entry Point: $15.10

Stop Loss: $16.00

Target Price: $13.35

As an insurance policy, we recommend buying a March $16 Call Option for 20 cents. This ensures that if the trade goes against us, we are protected by the call option. To compensate for the 20 cents cost of the option, our target price is lowered to $13.35 to make sure that we will still profit the 10% that we are shooting for. Note that one call option contract represents 100 shares. That is if you short 200 shares, you should buy 2 contracts.

We are closing RVBD at 15.89 with a 5.1% loss. However, the $16 call option that was bought at $0.20 as an insurance policy is kept open. That contract expires on Friday and we will sell it then. The call option is presently trading at $0.30.