| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Tredegar Corporation (TG) manufactures and sells plastic films and aluminum extrusions worldwide.

Tredegar Corporation (TG) manufactures and sells plastic films and aluminum extrusions worldwide.

The company offers apertured film and nonwoven materials for use in feminine hygiene products, baby diapers, and adult incontinence products under the SoftQuilt, ComfortAire, SoftAire, and FreshFeel names; the ExtraFlex, FabriFlex, StretchTab, FlexAire, and FlexFeel names; and absorbent transfer layers for baby diapers and adult incontinence products under the AquiDry and AquiSoft names.

It also provides single and multi-layer surface protection films under the UltraMask and ForceField names for protecting components of flat panel displays; a line of packaging films for food packaging and industrial applications; and apertured films, breathable barrier films, and laminates t hat regulate fluid or vapor transmission. In addition, the company offers soft-alloy aluminum extrusions primarily for building and construction, distribution, transportation, electrical, consumer durables, and machinery and equipment markets; and manufactures mill, anodized, and painted aluminum extrusions for fabricators and distributors to produce curtain walls, storefronts, windows and doors, hurricane shutters, tub and shower enclosures, heatsinks and components for light emitting diode (LED) lighting, and automotive and light truck aftermarket parts. Further, it develops and produces microstructure-based optical films for the LED and fluorescent lighting markets.

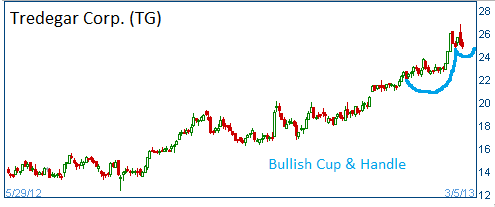

Shares have formed a bullish "cup & handle" formation and higher prices are expected for this stock.

We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Trading Range: $12.33 - $26.78

Last Trade: $24.30

Stop Loss: $23.17

Target Price: $26.85

Trailing P/E (ttm, intraday): 28.34

Forward P/E (fye Dec 31, 2014): 14.52

PEG Ratio (5 yr expected): 0.80

Price/Sales (ttm): 0.90

Price/Book (mrq): 2.14

Enterprise Value/Revenue (ttm): 1.00

Enterprise Value/EBITDA (ttm): 8.31

Share Statistics Share Statistics

Avg Vol (3 month)3: 83,882

Avg Vol (10 day)3: 123,600

Shares Outstanding5: 32.02M

Float: 22.86M

% Held by Insiders1: 26.70%

% Held by Institutions1: 61.10%

Shares Short (as of Jan 31, 2013): 523.01K

Short Ratio (as of Jan 31, 2013): 7.70

Short % of Float (as of Jan 31, 2013): 2.60%

Shares Short (prior month): 495.54K

TG is up $1.13 to $27.31. Our target price was $26.85. We are closing the position at $27.31. Tredegar is still a great company. If you elect to stay in the position, raise your stop loss to $27 to protect your gains.

TG continues to power high. Our original entry point was $24.31 on 2/27/2013. Our original target price was $26.85. The position was closed at $27.31 on March 8. We said then that Tredegar is still a great company. If you elect to stay in the position, you need to raise your stop loss to $29 from $27 to further protect your gains.