| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Monotype Imaging (TYPE) provides end-user and embedded text imaging solutions and services for use in print, Web, and mobile environments that enable people to create and consume content on various devices.

Monotype Imaging (TYPE) provides end-user and embedded text imaging solutions and services for use in print, Web, and mobile environments that enable people to create and consume content on various devices.

It offers a collection of approximately 170,000 font products consisting of its own and third-party owned fonts through its e-commerce Websites, including fonts.com, linotype.com, ascenderfonts.com, and itcfonts.com; a Web font service through webfonts.fonts.com for Website design; monotype, linotype, ITC, and ascender originals typeface libraries; custom font design services for corporate branding and identity; and PCL 6 and PostScript 3 font collections.

The companys software technologies embedded in various consumer electronics, including laser printers, digital copiers, mobile phones, e-book readers, tablets, automotive displays, digital cameras, navigation devices, digital televisions, set-top boxes, and consumer appliances, as well as in various software applications and operating systems. Its customers include consumer electronic device manufacturers, independent software vendors, and content creators.

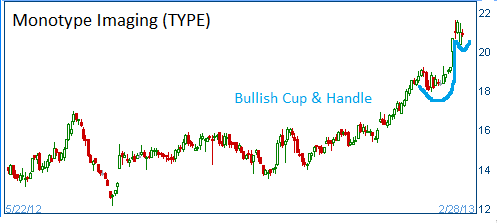

Shares have formed a bullish "cup and handle" and higher prices are expected for this stock.

Market Cap: 763.65M

Trailing P/E (ttm): 27.50

Forward P/E (fye Dec 31, 2014)1: 15.81

PEG Ratio (5 yr expected)1: 1.30

Price/Sales (ttm): 5.10

Price/Book (mrq): 3.25

Enterprise Value/Revenue (ttm): 5.01

Enterprise Value/EBITDA (ttm): 13.14

Profit Margin (ttm): 19.33%

Operating Margin (ttm): 31.01%

52-Week Trading Range: $12.15 - $21.57

Entry Point: $20.80

Stop Loss: $19.75

Target Price: $22.90

We are closing TYPE position at $22.17 as shares have been in the portfolio for 30-days. We had a return of 6.6% which is less than the desired 10% but still "a profit is a profit."