| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

This is a short pick. It means, we expect shares to drop in price. Please follow the stop losses carefully as shorting a stock could make your losses unlimited (theoretically that is). You must have a margin account to short. Shorting is not allowed in most retirement accounts.

EZchip Semiconductor Ltd. (EZCH) develops and markets Ethernet network processors for networking equipment. Its network processors include processing and classifying engines, traffic managers, media access controllers, and various hardware blocks, which enable customers to design multi-port line cards.

EZchip Semiconductor Ltd. (EZCH) develops and markets Ethernet network processors for networking equipment. Its network processors include processing and classifying engines, traffic managers, media access controllers, and various hardware blocks, which enable customers to design multi-port line cards.

Further, the company provides a library comprising Metro Ethernet protocols, Multi-Protocol Label Switching, IPv4 and IPv6 routing, Access Control Lists, GPON/EPON OLT functionality, Network Address Translation, and Server Load Balancing that features data plane code for various applications. It serves networking equipment vendors through direct sales representatives, contract manufacturers, and distributors primarily in Israel, China, Hong Kong, the Far East, Canada, the United States, and Europe.

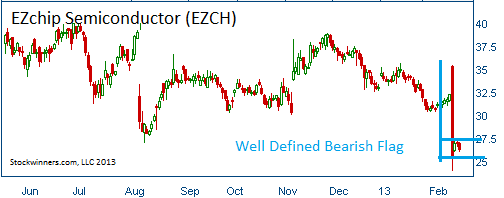

Shares have formed a bearish "flag" following the company's quarterly results. Details of the report are listed below. The main reason that shares plunged, however, was potential loss of a customer. The company disclosed that one of its customers is developing its own chips. The company disclosed that Huawei Technologies Co., a Chinese maker of telecommunications equipment, is developing an internal processor and will use EZchip’s product only “when needed.” Huawei, together with Ericsson AB and Tellabs Inc., comprised about 5 percent of EZchip’s revenue in 2012. That does not sound a huge reason for the stock to tank but let's look at another company that made a similar announcement awhile ago. Juniper, which in 2009 accounted for 54 percent of EZchip’s revenue, is transitioning to internally developed chips for its networking systems, a move that could seriously impact EZchip’s sales if other customers don’t make up for the loss. The announcement from Huawei added to the investors fears that EZchips' products are not keeping up with the market.

EZchip said on its earnings call that 2012 revenue fell 14 percent to $54.7 million as adjusted earnings sank 16 percent to 92 cents per share. Revenue could reach $160 million by 2016, down from the roughly $250 million the company earlier expected based on previous predictions.

52-week Trading Range: $24.00 - $46.79

Entry Point: $26.25

Stop Loss: $27.85

Target Price: $23.27

As an insurance policy, we recommend buying a March $28 Call Option for 40 cents. This ensures that if the trade goes against us, we are protected by the call option. To compensate for the 40 cents cost of the option, our target price is lowered to $23.35 to make sure that we will still profit the 10% that we are shooting for.

We are closing this short position at $23.27 with an 11.2% gain.