| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Omnicell (OMCL) provides automated solutions for hospital medication and supply management.

Omnicell (OMCL) provides automated solutions for hospital medication and supply management.

The company offers medication use products, which include OmniRx that automates the management and dispensing of medications at the point of use; SinglePointe, a software product that controls medications on a patient-specific basis; AnywhereRN, a software that allows nurses to remotely operate automated dispensing cabinets; Pandora Analytics, a reporting and data analytics tool; and Savvy Mobile Medication System, a mobile platform for hospital information systems.

Its medication use products also include OmniLinkRx, a software product that automates communication between nurses and the pharmacy; WorkflowRx, an automated storage, retrieval, inventory management, and repackaging solution; controlled substance barcode inventory management system; and Anesthesia Workstation, a secure dispensing system for the management of anesthesia supplies and medications.

In addition, the company provides medical and surgical supply products, which comprise Omnicell Supply Solution that automates the management and dispensing of medical and surgical supplies at the point of use; Supply/Rx Combination Solution, which manages medications and supplies in one versatile cabinet; Omnicell Tissue Center that manages the chain of custody for bone and tissue specimens; OptiFlex SS, which supplies modules for the perioperative areas; OptiFlex CL that supplies modules for the cardiac catheterization lab and other procedure areas; and OptiFlex MS, a system for the management of medical and surgical supplies.

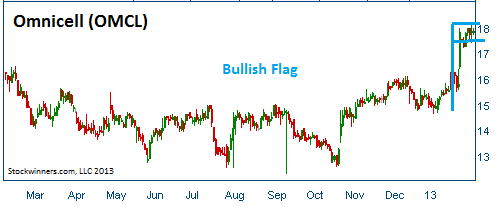

Shares have formed a bullish "flag" following the company's better than expected quarterly results. We are now hearing rumors of good news for this company that should push the shares higher out of this formation.

One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

Market Cap: $594.75M

Trailing P/E (ttm): 38.02

Forward P/E (fye Dec 31, 2014): 15.14

PEG Ratio (5 yr expected)1: 1.15

Price/Sales (ttm): 1.89

Price/Book (mrq): 1.93

52-Week Trading Range: $12.33 - $18.14

Entry Point: $17.75

Stop Loss: $16.85

Target Price: $19.55

We are closing OMCL at $19.81 after it exceeded our target price. We had a return of 11.8%. If you elect to stay in the position, please adjust your stop loss upward to protect your profit.