| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Tupperware Brands (TUP) operates as a direct seller of various products across a range of brands and categories through an independent sales force worldwide.

Tupperware Brands (TUP) operates as a direct seller of various products across a range of brands and categories through an independent sales force worldwide.

It engages in the manufacture and sale of preparation, storage, and serving solutions for the kitchen and home, as well as a line of kitchen cookware and tools, microwave products, microfiber textiles, and gifts under the Tupperware brand name.

The company also manufactures and distributes beauty and personal care products, including skin care products, cosmetics, bath and body care, toiletries, fragrances, and nutritional products under the Armand Dupree, Avroy Shlain, BeautiControl, Fuller, NaturCare, Nutrimetics, and Nuvo brands.

It sells its products directly to distributors, directors, managers, and dealers.

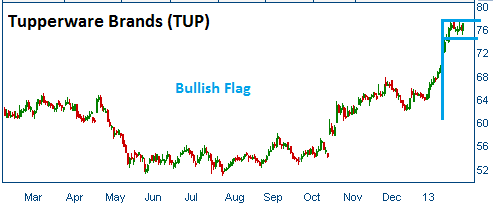

Shares have formed a bullish "flag" following the company's quarterly results. Shares are expected to head higher out of this formation.

Market Cap: $4.18B

Trailing P/E (ttm): 22.49

Forward P/E: 11.93

PEG Ratio (5 yr expected): 1.11

Price/Sales (ttm): 1.60

Price/Book (mrq): 8.66

Enterprise Value/Revenue (ttm): 1.79

Enterprise Value/EBITDA (ttm): 10.35

52-Week Trading Range: $50.90 - $77.39

Entry Point: $76.70

Stop Loss: $73.00

Target Price: $84.25

mrq = Most Recent Quarter

ttm = Trailing Twelve Months

We are closing TUP at $78.73 as our 30-day time frame expires. We still believe that the company is a solid one but we are moving to another trade. We had a return of 2.95%.