| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

J.B. Hunt Transport Services (JBHT) provides transportation and delivery services in the continental United States, Canada, and Mexico.

J.B. Hunt Transport Services (JBHT) provides transportation and delivery services in the continental United States, Canada, and Mexico.

The company operates in four segments: Intermodal (JBI), Dedicated Contract Services (DCS), Full-Load Dry-Van (JBT), and Integrated Capacity Solutions (ICS).

The JBI segment provides intermodal freight solutions, including origin and destination pickup, and delivery services. This segment operates approximately 54,506 pieces of company-controlled trailing equipment; and manages a fleet of approximately 2,901 company-owned tractors. The DCS segment designs, develops, and executes supply-chain solutions, which support various transportation networks. It offers final mile delivery, replenishment, and specialized services supporting private fleet conversion, fleet creation, and transportation system augmentation. As of December 31, 2011, this segment operated 4,571 company-owned, 330 customer-owned, and 17 independent contractor trucks. The JBT segment provides full-load and dry-van freight services by utilizing tractors operating over roads and highways. This segment operated 1,637 company-owned tractors. The ICS segment provides non-asset, asset-light, and transportation logistics solutions; and flatbed, refrigerated, less-than-truckload, and expedited, as well as various dry-van and intermodal solutions. This segment also offers single-source logistics management for customers that desire to outsource their transportation functions.

In addition, the company transports, or arranges for the transportation of, a range of freight, including general merchandise, specialty consumer items, appliances, forest and paper products, food and beverages, building materials, soaps and cosmetics, automotive parts, electronics, and chemicals.

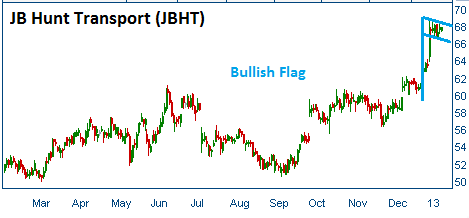

Shares have formed a bullish "flag" and are expected to head higher out of this formation.

52-Week Trading Range: $49.98 - $68.58

Last Trade: $68.00

Stop Loss: $64.60

Target Price: $74.80

We are exiting JBHT at $69.25. It has not reached our target price but the 30-days is over. Proceeds were invested in SLCA.