| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Novo Nordisk A/S (NVO) engages in the discovery, development, manufacture, and marketing of pharmaceutical products primarily in Denmark.

Novo Nordisk A/S (NVO) engages in the discovery, development, manufacture, and marketing of pharmaceutical products primarily in Denmark.

It operates in two segments, Diabetes Care and Biopharmaceuticals.

The Diabetes Care segment covers insulins, GLP-1 analog, obesity, and oral antidiabetic drugs, as well as other protein related products comprising glucagon, protein related delivery systems, and needles.

The Biopharmaceuticals segment offers products in the areas of haemophilia, growth hormone therapy, hormone replacement therapy, and inflammation.

The company sells its products primarily in North America, China, Japan, Algeria, Argentina, Australia, Brazil, India, Turkey, and European countries through its subsidiaries, distributors, and independent agents.

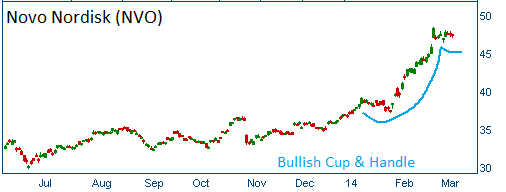

Shares have formed a bullish "cup and handle" and higher share prices are expected for this stock.

52-Week Trading Range: $29.90 - $48.42

Entry Point: $46.78

Stop Loss: $44.45

Target Price: $51.45

NVO fell below our stop loss. We still believe in the stock. Position closed at $44.49.