| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

MedAssets (MDAS) is a financial and performance improvement company.

MedAssets (MDAS) is a financial and performance improvement company.

The firm provides technology-enabled products and services for hospitals, health systems, and other ancillary healthcare providers in the United States.

It operates in two segments, Spend and Clinical Resource Management (SCM) and Revenue Cycle Management (RCM). The SCM segment provides a suite of cost management services, supply chain analytics, and data capabilities; strategic sourcing and group purchasing services; medical device and clinical resource consulting services; lean performance improvement services; workforce management; and supply chain outsourcing and procurement services. This segment is also involved in the provision of business intelligence and decision support tool services. The RCM segment offers a suite of software as a service or Web-based software and technology-enabled services, which address various revenue cycle processes comprising patient access and financial responsibility, clinical documentation, charge capture and revenue integrity, pricing analysis, claims processing, denials management and reimbursement integrity, payer contract management, extended business office revenue recovery, accounts receivable services, and outsourcing services.

As of December 31, 2013, the company served approximately 4,400 acute care hospitals and approximately 122,000 ancillary or non-acute provider locations.

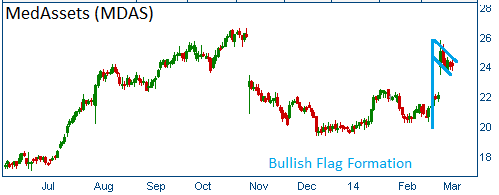

Shares have formed a bullish "flag" following the firm's better than expected quarterly results. We are now hearing rumors of good news for this company that should push shares higher out of this formation.

One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Trading Range: $16.31 - $26.58

Entry Point: $24.06

Stop Loss: $22.85

Target Price: $26.47

We are locking profits on MDAS at $24.87.