| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Tata Motors Limited (TTM) is an automobile company. The firm engages in the manufacture and sale of commercial and passenger vehicles primarily in India.

Tata Motors Limited (TTM) is an automobile company. The firm engages in the manufacture and sale of commercial and passenger vehicles primarily in India.

The companys product portfolio includes micro, compact, and midsize passenger cars; premium and luxury sports utility vehicles and cars; utility vehicles; small, light, intermediate, and medium and heavy commercial vehicles; and defense and homeland security vehicles, as well as vans, trucks, and buses and coaches. It also develops electric and hybrid vehicles for personal and public transportation.

In addition, the company is involved in distributing and marketing cars; financing the vehicles sold by dealers; and sale of spare parts and accessories. Further, it engages in the provision of engineering and automotive solutions, as well as machine tools and factory automation solutions; construction equipment manufacturing; automotive vehicle components manufacturing and supply chain activities; provision of tooling, and plastic and electronic components for automotive and computer applications; and automotive retailing and service operations.

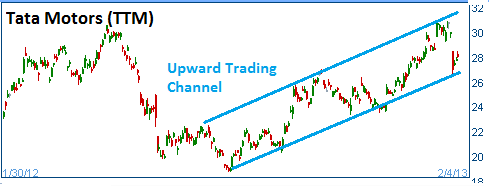

The Company also owns Jaguary and Land Rover. Shares fell last week after its preliminary results for sale at its JLR division came lower than expected. Shares are heading higher in an upward trading channel. The news of last week brought shares to the lower boundary of the said channel. Higher prices are expected for this stock. The stock should also be helped after the Central Bank of India cut its bench interest rate last night.

52-Week Trading Range: $18.83 - $30.85

Entry Point: $28.21

Stop Loss: $26.84

Target Price: $31.08

TTM position was closed at $26.80 after it fell through our stop loss.