| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Group 1 Automotive (GPI) engages in the marketing and sale of automotive products and services. It sells new and used cars, light trucks, and vehicle parts. The company also provides vehicle financing services; service and insurance contract services; and automotive maintenance and repair services.

Group 1 Automotive (GPI) engages in the marketing and sale of automotive products and services. It sells new and used cars, light trucks, and vehicle parts. The company also provides vehicle financing services; service and insurance contract services; and automotive maintenance and repair services.

The company has operations located in metropolitan areas in the states of Alabama, California, Florida, Georgia, Kansas, Louisiana, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New York, Oklahoma, South Carolina, and Texas in the United States; and in the towns of Brighton, Hailsham, and Worthing in the United Kingdom.

As of October 25, 2012, it owned and operated 121 automotive dealerships, 158 franchises, and 30 collision centers in the United States and the United Kingdom that offer 32 brands of automobiles.

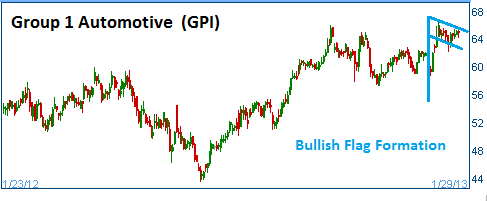

Shares have formed a bullish "flag" and higher prices are expected for this stock. Note that all of auto companies have reported healthy care sales which should bode well for auto dealers. The Company reports its quarterly results on Feb. 19. Note that the stock was upgraded this morning by KeyBank with a $77 target price.

52-Week Trading Range: $43.63 - $66.50

Entry Point: $66.00

Stop Loss: $62.70

Target Price: $72.60

We closed this position at a loss ($62) after its earnings report came below expectations. Our entry point was $66.00 with a stop loss of $62.30. It was painful!