| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

NuVasive (NUVA) is a medical device company.

NuVasive (NUVA) is a medical device company.

The firm engages in the design, development, and marketing of minimally disruptive surgical products and procedurally integrated solutions for the spine.

The companys products focus on applications for spine fusion surgery. It offers products for the thoracolumbar spine and the cervical spine primarily used to enable access to the spine and to perform restorative and fusion procedures in a minimally disruptive fashion. The companys principal products include a minimally disruptive surgical platform called Maximum Access Surgery (MAS), as well as cervical, biologics, and motion preservation products. Its MAS platform combines three categories of product offerings, including NVM5 and NVJJB, its proprietary software-driven nerve detection and avoidance systems, and intra-operative monitoring support services for insight into the nervous system during spine and other surgeries; MaXcess, an integrated split-blade retractor system; and various specialized implants.

The companys biologic products include allograft, a donated human tissue; FormaGraft, a collagen synthetic product; Osteocel Plus, an allograft cellular matrix containing viable mesenchymal stem cells; and AttraX, a synthetic bone graft material. It also offers solutions for cervical fusion surgery, including allograft and CoRoent implants, as well as cervical plating and posterior fixation products. In addition, the companys products comprise PCM device, a motion preserving total disc replacement device; and XL TDR, a mechanical total disc replacement solution.

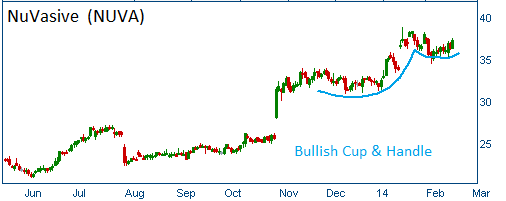

Shares have formed a bullish "cup & handle" and higher share prices are expected. Furthermore, when the firs reports its quarterly results on March 3rd, we expect a strong report from the firm.

52-Week Trading Range: $17.01 - $38.79

Entry Point: $37.00

Stop Loss: $35.15

Target Price: $40.70

We are closing NUVA at $39.05 after it failed to reach our target price in less than 30 days! We had a 5.5% gain.