| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

CBOE Holdings (CBOE) operates markets for the trading of listed derivatives.

CBOE Holdings (CBOE) operates markets for the trading of listed derivatives.

The company provides marketplaces for trading options on the stocks of individual corporations; options on various market indexes; options on other exchange-traded products, such as exchange-traded funds and exchange-traded notes; and futures products through its futures market.

It operates CBOE exchange, which offers trading for listed options through a single system that integrates electronic trading and traditional open outcry trading on its trading floor in Chicago; C2, an all-electronic exchange that also offers trading for listed options; and CFE, an all-electronic futures exchange, which offers futures on the VIX Index, as well as on other products.

The companys exchanges operate on its proprietary technology platform, known as CBOE Command.

The firm reported earnings last week that beat the estimates. Net income increased to $45.6 million, or 52 cents a share, in the quarter, from $39.2 million, or 45 cents a share, in the same period a year earlier. Analysts expected 48 cents a share. The earnings represented CBOE's "best fourth-quarter results ever," the company said.

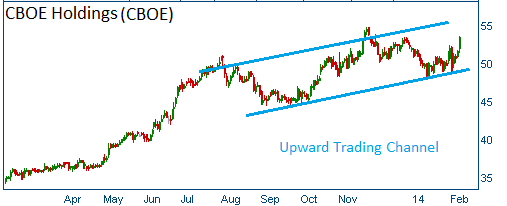

Shares are heading higher in an upward trading channel, and the earnings report pushed shares higher in the trading channel. Shares are expected to head higher.

52-Week Trading Range: $34.17 - $54.79

Entry Point: $54.20

Stop Loss: $51.49

Target Price: $59.62

We are closing CBOE position after its 30-day period expired without reaching our target price. Closed at $56.