| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Nationstar Mortgage Holdings (NSM) engages in the servicing of residential mortgage loans in the United States. It is also involved in the origination and sale or securitization of single-family conforming mortgage loans to government-sponsored entities or other third party investors in the secondary market.

Nationstar Mortgage Holdings (NSM) engages in the servicing of residential mortgage loans in the United States. It is also involved in the origination and sale or securitization of single-family conforming mortgage loans to government-sponsored entities or other third party investors in the secondary market.

The company services a range of mortgage loans, including prime and non-prime loans, traditional and reverse mortgage loans, and GSE and government agency-insured loans, as well as private-label loans issued by non-government affiliated institutions. As of December 31, 2011, it serviced approximately 645,000 residential mortgage loans to national and regional banks, government organizations, securitization trusts, private investment funds, and other owners of residential mortgage loans and securities.

In addition, the company originates conventional agency and government residential mortgage loans. Further, it offers various ancillary services, including providing services for delinquent loans; managing loans in the foreclosure/real estate owned process; and providing title insurance agency, loan settlement, and valuation services on newly originated and re-originated loans.

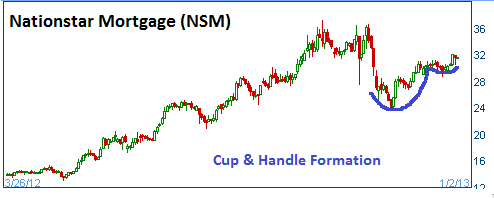

Shares have formed a bullish "cup & handle" and higher prices are expected for this stock.

52-Week Trading Range: $13.00 - $37.20

Entry Point: $31.40

Stop Loss: $29.85

Target Price: $34.55