| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

The Ryland Group (RYL) operates as a homebuilder and a mortgage-finance company in the United States. It engages in the design, construction, and sale of homes, as well as provides mortgage, title insurance, escrow, and insurance services.

The Ryland Group (RYL) operates as a homebuilder and a mortgage-finance company in the United States. It engages in the design, construction, and sale of homes, as well as provides mortgage, title insurance, escrow, and insurance services.

The company offers single-family detached homes; and attached homes, such as townhomes, condominiums, and mid-rise buildings, as well as sells lands and lots. It builds homes for entry-level buyers, as well as for first and second-time move-up buyers.

The Company's homes are built on-site and marketed in four geographic regions or segments: North, Southeast, Texas and West. Its North segment includes Baltimore, Chicago, Indianapolis, Minneapolis, Northern Virginia and Washington, D.C. Its Southeast include Atlanta, Charleston, Charlotte, Orlando and Tampa. Texas includes Austin, Houston and San Antonio. West includes Denver, Las Vegas and Southern California. During 2011, within each of those segments, the Company operated in the metropolitan areas of North, Southeast, Texas and West.

Each of its homebuilding divisions across the country consists of a division president; a controller; management personnel focused on land entitlement, acquisition and development, sales, construction, customer service and purchasing, and accounting and administrative personnel.

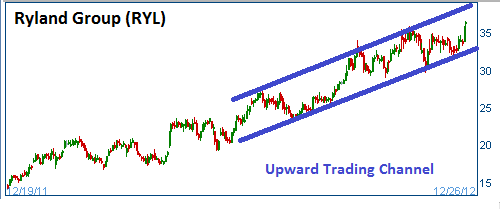

Shares are heading higher in an upward trading channel.

52-Week Trading Range: $14.14 - $37.00

Last Trade: $36.55

Stop Loss: $34.75

Target Price: $40.25

We are closing this position at $39.63 as our 30-day expired. This stock remains a solid performer. IF you elect to stay in this stock, please adjust your stop loss upward.