| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Myriad Genetics (MYGN) focuses on the development and marketing of predictive medicine, personalized medicine, and prognostic medicine tests primarily in the United States. Its molecular diagnostic tests are designed to analyze genes, their mutations, expression levels, and proteins to assess an individuals risk for developing disease later in life; determine a patients likelihood of responding to a particular drug; assess a patients risk of disease progression and disease recurrence; and measure a patients exposure to drug therapy to ensure optimal dosing and reduced drug toxicity.

Myriad Genetics (MYGN) focuses on the development and marketing of predictive medicine, personalized medicine, and prognostic medicine tests primarily in the United States. Its molecular diagnostic tests are designed to analyze genes, their mutations, expression levels, and proteins to assess an individuals risk for developing disease later in life; determine a patients likelihood of responding to a particular drug; assess a patients risk of disease progression and disease recurrence; and measure a patients exposure to drug therapy to ensure optimal dosing and reduced drug toxicity.

The company offers various molecular diagnostic tests that include BRACAnalysis predictive medicine test for hereditary breast and ovarian cancer; COLARIS medicine test for hereditary colorectal and uterine cancer; COLARIS AP predictive medicine test for hereditary colorectal cancer; and MELARIS medicine test for hereditary melanoma.

It also provides OnDose, a personalized medicine test that is designed to assist oncologists in optimizing 5-FU (fluorouracil) anti-cancer drug therapy in colon cancer patients; PANEXIA, a predictive medicine test for pancreatic cancer; PREZEON, a personalized and prognostic medicine test for cancer; Prolaris, a prognostic medicine test for prostate cancer; and TheraGuide 5-FU, a personalized medicine test for drug toxicity.

In addition, the company, through its subsidiary, Myriad RBM, Inc., offers biomarker discovery and companion diagnostic services to the pharmaceutical, biotechnology, and medical research industries that include multi-analyte profile testing services; multiplexed immunoassay kits; and TruCulture, a self-contained whole blood culture that allows pharmaceutical and biotechnology companies to identify drug toxicity prior to human trials.

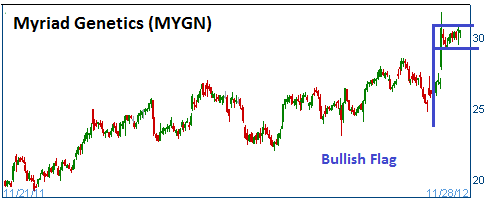

Shares have formed a bullish "flag" after the company reported better than expected results. The firm also guided higher going forward. Higher prices are expected for the stock.

52-Week Trading Range: $19.21 - $31.80

Last Trade: $30.25

Stop Loss: $28.74

Target Price: $33.28