| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Riverbed Technology (RVBD) provides solutions to the fundamental problems associated with information technology (IT) performance across wide area networks (WANs) in the United States and internationally.

Riverbed Technology (RVBD) provides solutions to the fundamental problems associated with information technology (IT) performance across wide area networks (WANs) in the United States and internationally.

It offers Steelhead products, which enable customers to enhance the performance of applications and access data across WANs. The companys Steelhead products include the Steelhead Mobile that provides mobile workers with LAN-like access to corporate files and applications; Virtual Steelhead appliance to extend the WAN optimization; Cloud Steelhead, a solution for public cloud computing environments; Central Management Console that provides centralized configuration, monitoring, and control for deploying and managing Steelhead products across a WAN; and Interceptor appliance, which allows organizations to scale their WAN optimization solutions.

It also offers Granite appliances that allow IT to consolidate servers and storage from branch offices to the data center without compromising branch application performance; and Cascade appliances, which help organizations to manage, secure, and optimize the availability and performance of global applications. In addition, the company provides OPNET products that use various technologies to support the analysis of application, network, and server performance under a range of conditions; Stingray product line, which provides virtual application delivery control; and Whitewater, a cloud storage appliance to accelerate, deduplicate, secure, and store backup data sets in the public cloud.

It serves customers in manufacturing, finance, technology, government, architecture, engineering and construction, professional services, utilities, healthcare and pharmaceuticals, media, and retail industries.

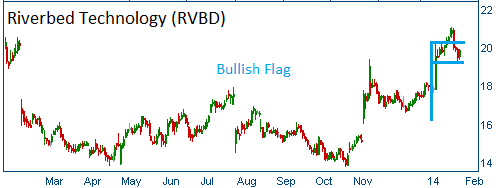

Shares have formed a bullish "flag" and higher share prices are expected for this stock. The rise in shares came on January 15th. Riverbed said it expected to report non-GAAP Q4 revenue of $284 million to $285 million, vs. its previous guidance of $270 million to $276 million. It expects earnings per share minus items of 30 or 31 cents, compared with prior guidance of 26 or 27 cents. Analysts had expected revenue of $274.8 million and EPS ex items of 27 cents. Riverbed also said its board had unanimously rejected the unsolicited $19-per-share buyout offer from Elliot Management. Elliott, though, said it was leaving the door open for a higher buyout offer.

52-Week Trading Range: $13.77 - $21.07

Entry Point: $19.60

Stop Loss: $18.62

Target Price: $21.56

We are closing RVBD trade after it failed to reach our target price in 30 days or less.