| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Portfolio Recovery Associates (PRAA) engages in the purchase, collection, and management of portfolios of defaulted consumer receivables in the United States and the United Kingdom.

Portfolio Recovery Associates (PRAA) engages in the purchase, collection, and management of portfolios of defaulted consumer receivables in the United States and the United Kingdom.

It detects, collects, and processes unpaid and normal-course accounts receivables owed primarily to credit grantors, governments, retailers, and others. The company also acquires receivables of Visa and MasterCard credit cards, private label and other credit cards, installment loans, lines of credit, bankrupt accounts, deficiency balances of various types, legal judgments, and trade payables from various debt owners, including banks, credit unions, consumer finance companies, telecommunication providers, retailers, utilities, insurance companies, medical groups, hospitals, auto finance companies, and other debt buyers.

In addition, it provides fee-based services comprising vehicle location, skip tracing, and collateral recovery services for auto lenders, governments, and law enforcement; revenue administration, audit, and debt discovery/recovery services for local government entities; and class action claims settlement recovery and related payment processing services.

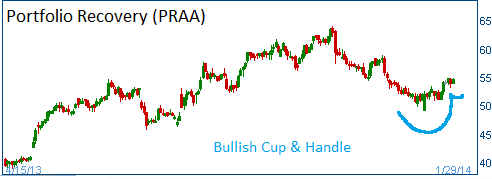

Shares have formed a bullish "cup & handle" and higher share prices are expected for this stock.

52-Week Trading Range: $34.05 - $63.96

Entry Point: $54.50

Stop Loss: $51.77

Target Price: $59.95

PRAA fell below our stop loss. Position closed at $51.50