| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

PVH Corp. operates as an apparel company in the United States, Canada, Europe, and internationally.

PVH Corp. operates as an apparel company in the United States, Canada, Europe, and internationally.

The company designs, sources, and markets sportswear, footwear, athletic apparel, underwear, robes, sleepwear, eyewear, sunwear, watches, handbags, mens tailored clothing, mens dress furnishings, socks, small leather goods, fragrances, home and bedding products, bathroom accessories, and luggage; and jeanswear, bags, accessories, jewelry, watches, home furnishings, hosiery, womens performance apparel, dress shirts, and neckwear.

Its brand portfolio includes owned brands comprising designer lifestyle brands, such as Calvin Klein and Tommy Hilfiger brands, as well as Van Heusen, IZOD, Bass, ARROW, and Eagle; and licensed brands consisting of Geoffrey Beene, Kenneth Cole New York, Kenneth Cole Reaction, Sean John, JOE Joseph Abboud, MICHAEL, Michael Kors, Michael Kors Collection, CHAPS, Donald J. Trump Signature Collection, DKNY, Elie Tahari, Nautica, Ted Baker, J. Garcia, Claiborne, Robert Graham, U.S. POLO ASSN., Axcess, and Jones New York, as well as various other licensed and private label brands.

PVH Corp. markets its products through wholesale to national and regional department, mid-tier department, mass market, and specialty and independent stores; and retail stores, as well as through e-commerce Website. It leases and operates approximately 1,000 retail locations.

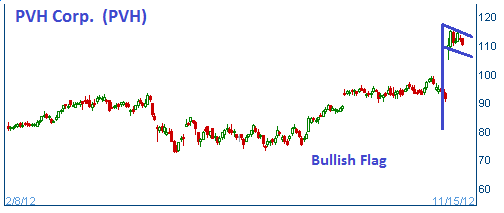

Shares have formed a bullish "flag" after PVH announced a deal to buy rival Warnaco Group (WRC) for $1.8B. The move brings all of the Calvin Klein brand products to PVH. Investors applauded the move and bid up of shares of PVH. The firm reports its earnings on November 27, and the report is expected to be a solid one.

52-Week Trading Range: $62.81 - $115.82

Last Trade: $110.00

Stop Loss: $104.50

Target Price: $121.00

We closed the position at $111.80 since our 30-day is expired