| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

DigitalGlobe (DGI) provides commercial earth imagery products and information services worldwide. It collects imagery products and services through its QuickBird, WorldView-1, and WorldView-2 satellites, as well as aerial and satellite imagery from third party suppliers.

DigitalGlobe (DGI) provides commercial earth imagery products and information services worldwide. It collects imagery products and services through its QuickBird, WorldView-1, and WorldView-2 satellites, as well as aerial and satellite imagery from third party suppliers.

The company offers a range of online and offline distribution options, including desktop software applications; Web services, which provide direct online access to the companys image library; file transfer protocol; physical media, such as CD, DVD, and hard drive; and direct access program that facilitates certain customers to task and download data from its WorldView-1 and WorldView-2 satellites.

Its imagery products and services support various uses, including defense, intelligence and homeland security, mapping and analysis, environmental monitoring, oil and gas exploration, and infrastructure management. DigitalGlobe, Inc. serves defense contractors; civil government agencies; providers of location-based services; and various companies in energy, telecommunications, utility, forestry, mining, financial services, environmental, and agricultural industries through direct and indirect channels.

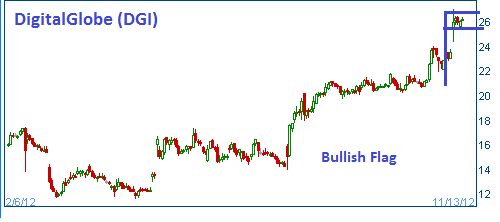

Shares have formed a bullish flag after the firm reported better than expected earnings and guided higher going forward. Higher prices are expected for this stock.

52-Week Trading Range: $11.61 - $27.00

Last Trade: $26.15

Stop Loss: $24.84

Target Price: $28.77