| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Methode Electronics (MEI) engages in the design, manufacture, and marketing of components and subsystem devices worldwide.

Methode Electronics (MEI) engages in the design, manufacture, and marketing of components and subsystem devices worldwide.

Its Automotive segment provides electronic and electro-mechanical devices and related products to automobile original equipment manufacturers. Its products include control switches for electrical power and signals, connectors for electrical devices, integrated control components, switches and sensors that monitor the operation or status of a component or system, and packaging electrical components. The companys Interconnect segment offers copper and fiber-optic interconnect and interface solutions for the aerospace, appliance, commercial, computer, construction, consumer, material handling, medical, military, mining, networking, storage, and telecommunications markets.

Its solutions include conductive polymers, connectors, custom cable assemblies, industrial safety radio remote controls, optical and copper transceivers, personal computer and express card packaging and terminators, solid-state field effect interface panels, and thick film inks; and services comprise the design and installation of fiber optic and copper infrastructure systems, and manufacturing active and passive optical components. Its Power Products segment manufactures braided flexible cables, current-carrying laminated bus devices, custom power-product assemblies, high-current low voltage flexible power cabling systems, and powder coated bus bars for aerospace, computers, industrial and power conversion, inverters and battery systems, insulated gate bipolar transistor solutions, military, telecommunications, and transportation markets.

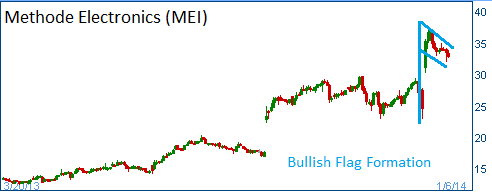

Shares have formed a bullish "flag" following its strong quarterly results on December 5. Higher share prices are expected for this stock.

52-Week Trading Range: $9.52 - $37.53

Entry Point: $33.40

Stop Loss: $31.70

Target Price: $36.75

MEI reached our target price. Postion closed at $36.75.